II. Implementation of Managerial Dismissal

- Section 5. ERP Bonus

-

1. Establishment of an Early Retirement Package (ERP) Bonus

(1) Purpose of an ERP Bonus

In general, a voluntary retirement system is similar to forced resignation in which employees whose positions cannot be maintained due to irregularity or redundancy should submit a resignation letter to the company in return for a certain level of compensation.

(2) Determining the Amount of Compensation

1) Minimum conditions

In accordance with Article 26 of the Labor Standards Act, rcn employer shall give an employee he or she plans to dismiss at least thirty daysch employees whose positions cannot be maiis not given, ordinary wages of at least thirty days shall be paid to the employee. company in return for a certain level of compensathirty days’ ordinary wages.

2) Ideal conditions

If there is a struggling labor union in the manufacturing industry, there may be a pre-selected retirement allowance in the collective agreement. In this case, negotiations will begin with the amount presented in the collective agreement.

Collective Agreement for T Elevator Co., Ltd. Regarding ERP Bonus

A. After the signing of this collective agreement, the company shall not dismiss union members for five years.

B. In the event of managerial dismissal within this period, union members being dismissed shall be paid an amount equivalent to the average wages for 20 months based on the average monthly wage calculated for the final three months.

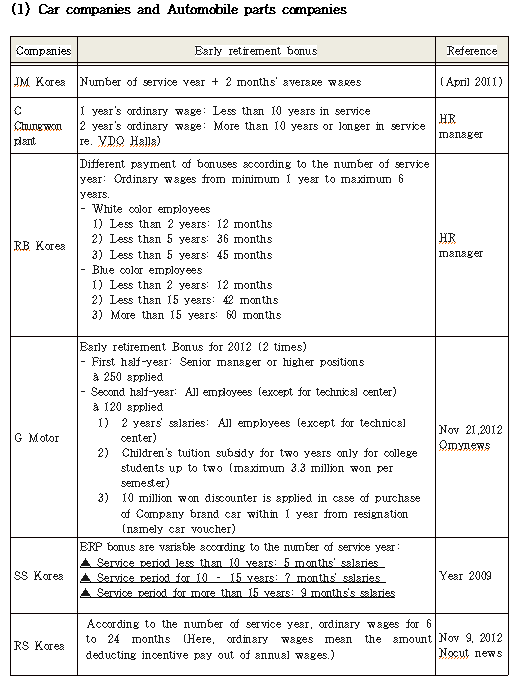

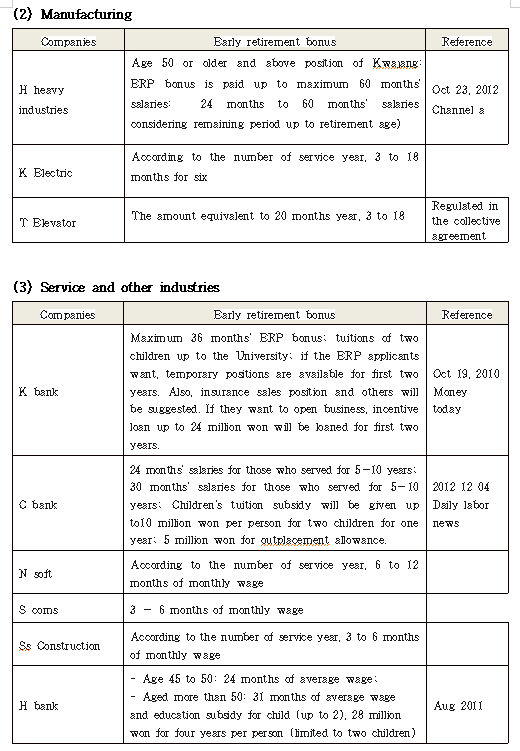

3) General criteria

General criteriamanagerial dismissal within this period, union members being dismissed shall be paid an amount equivalent to the average wages for 20 months based onidering the ability of the company to pay.

① Number of service years: The retirement benefit is determined by considering the number of service years an employee has with the company. In other words, if an employee has been working for at least five years, approximately six monthslevel of compensaly proposed, while for employees with less than five years of service, less than 6 months’ wages would be proposed.

② The company's ability to pay: This is determined by the company's competitiveness. For a bank or stable public corporation, the ERP bonus is often at least one year’s annual wage, but for very small companies or those with poor profit margins, less than 6 months’ pay would be offered.

(3) Desired Principle

1) The amount a company will pay as an ERP bonus to certain employees should be considered carefully as it will serve as a clear reference point for other potential target employees. As much as possible, it is advisable to treat the ERP bonus as a confidential matter between individual employees and the company.

2) If a company gives an ERP bonus upon termination of employment, it is critical that the company pay special attentions to avoid creating employment insecurity for the remaining employees. In other words, if a company utilizes a voluntary resignation system too often, those remaining may not hold much faith in their company’s ability to keep them employed, and will more likely move to companies where employment seems more secure. Therefore, plans for long-term development should be at the forefront when considering ERP bonuses for terminations.

2. Rules for Early Retirement Plan Bonuses

Established May 1, 2009

Article 1 (Purpose)

These rules are designed as basic guidelines for payment of an early retirement plan (hereinafter referred to as “ERP”) bonus applicable to employees of 000 Bank.

Article 2 (Definition of ERP bonus)

An ERP bonus is an additional bonus paid outside the severance pay regulated by the Rules of Employment, to employees who choose to resign due to company business normalization plans or employment adjustment plans (including headcount reduction plans).

Article 3 (Target Employees)

① These rules are applicable to regular employees as stipulated by the Company’s Rules of Employment.

② For full-time advisors and other positions equivalent to director status, other rules apply.

Article 4 (Calculation)

The ERP bonus will be based on calculation of standard severance pay as follows:

- Standard severance pay = Consecutive service years (N) X 30 days’ daily average wage

- EPR bonus = {[N+(N X 50%)] + 6} X 30 days’ daily average wage

Article 5 (Payment)

The Company shall pay out the ERP bonus within 14 days after the approved employee has finished employment (or passes away). Under certain circumstances, this period may be extended.

Article 6 (Exceptions)

1. These rules are applicable only to regular employees who have served for one year or longer.

2. Even though an employee qualifies for an ERP bonus by reason of resignation or other stipulations herein, if that employee has caused considerable difficulties to business and/or damage to property through intent or negligence, the Company is not obligated to pay that employee any ERP bonus.

③ If, through compromise or mediation between parties, the Company agrees to compensate an employee in the process of a legal dispute between itself and the employee regarding dismissal, these rules will not apply.

Supplementary Provision

Article 1 (Implementation) These rules shall be effective as of May 1, 2009.