Chapter 3 Exceptions from Application of Working Hours

- Ⅲ. Workplaces Ordinarily Employing Fewer than Five People

-

1. Introduction

Some workers are not protected by Korean labor law, or have limits to the protection offered. Representative examples include 1) workers at workplaces ordinarily employing fewer than five people, and 2) domestic workers. Article 11 of the Labor Standards Act (LSA) stipulates that “The Labor Standards Act shall apply to all businesses or workplaces in which five or more workers are ordinarily employed. This Act, however, shall not apply to any business or workplace which employs only relatives living together, or to workers hired for domestic work.”

In relation to such limitations on application of the Labor Standards Act, some problems have recently emerged. The first is that while labor rights are not completely applicable to people employed by workplaces ordinarily employing fewer than five people, they are now finding themselves eligible for severance pay, which in the past was not the case. This new situation has been at the heart of more labor disputes for those workers looking out for their own labor rights. Accordingly, it is necessary for workplaces ordinarily hiring fewer than five people to be aware of which articles of the LSA are applicable to their workers.

The second problem is that while it is evident that domestic workers exclusively working for a particular house are completely excluded from application of the LSA, this gets confusing when someone works for a company but is paid to be a housekeeper, butler, driver, etc. at the company president’s house. In particular, there are disputes related to workers getting injured at work, or whether the workers should receive severance pay or not.

2. Employees at Workplaces Ordinarily Employing Fewer than Five People

(1) Background

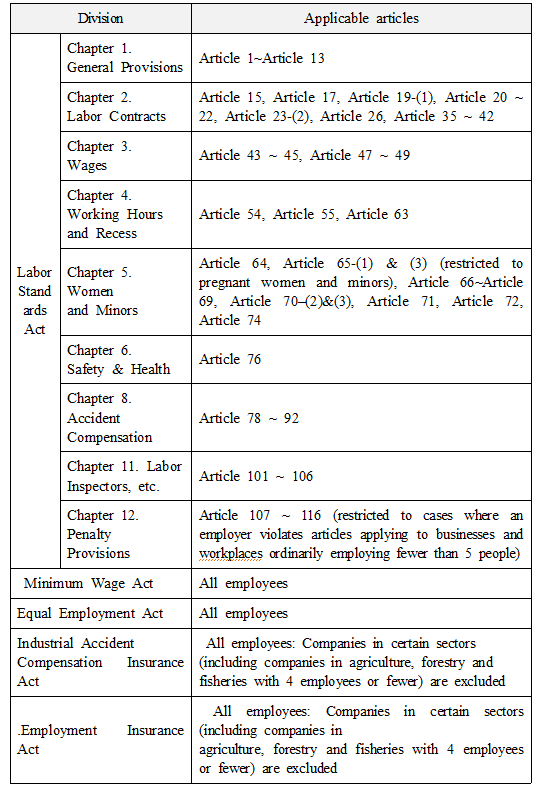

In December 2012, employees at workplaces employing fewer than five people became eligible for severance pay. This has brought a lot of attention to those workers in inferior situations. Major articles of the LSA that are not applicable to such workers include, among others, 1) restrictions on dismissal, 2) suspension allowances, 3) restrictions on extended work, 4) extended work, night work and holiday work, and 5) annual paid leave. Due to their exclusion from these protections, such employees often work in inferior working environments. In the following pages, I would like to look at and explain conditions which require and do not require LSA application.

(2) Major articles applicable to workplaces ordinarily employing fewer than five people

Topics related to major articles applicable to workplaces ordinarily employing fewer than five people include, among others, 1) written statement of the employment contract, 2) weekly holidays, 3) recesses, 4) accident compensation, 5) payment of money and valuables, 6) payment of wages, 7) restrictions on dismissal timing, 8) advance notice of dismissal, and 9) maternity leave.

Even though the restrictions on dismissal are not applicable, advance notice of dismissal is required, which means that an employer shall give at least thirty days’ advance notice to a worker the employer intends to dismiss. If notice is not given thirty days before the dismissal, ordinary wages of at least thirty days shall be paid to the worker. Most articles regarding wages to be paid for labor service are also applicable. That is, minimum wage applies, payment of wages shall be observed, and penalty provisions for delayed payment of wages are applicable. Of particular note, severance pay became mandatory on December 1, 2010 for the first time: for the two years until December 1, 2012, the employer had to pay 50% of full severance pay to resigning employees, and pay 100% for the period beginning January 2013. Regardless of the length of service, severance pay only began accruing from December 1, 2010. Also, according to Industrial Accident Compensation Insurance requirements, accident compensation for occupational injury, including medical treatment, suspension compensation, handicap compensation, etc. are applicable in the same way as for regular employees.

(3) Major articles not applicable to workplaces ordinarily employing fewer than five people

As the following LSA provisions do not apply to workers at workplaces ordinarily employing fewer than five people, working conditions for such employees are quite inferior.

1) Restrictions on dismissal, etc.

① An employer can arbitrarily dismiss or discipline workers without justifiable reason;

② Even though a worker is unfairly dismissed, the worker cannot apply to the Labor Relations Commission for remedy;

③ An employer does not have to notify workers in writing of reasons for dismissal;

④ As the restrictions on dismissal for managerial reasons do not apply to such workers, an employer can dismiss workers at any time if business conditions deteriorate;

⑤ The two-year limitation on the use of temporary workers such as dispatch employees or short-term contract workers does not apply, and the employer can dismiss such workers at any time.

2) Allowances during suspension of business When an employer suspends business operations, the workers are not entitled to receive suspension allowances. Even though business operations are suspended for reasons attributable to the employer, the employer does not have to pay allowances to workers during such suspensions.

3) Restrictions on working hours Workplaces ordinarily employing fewer than five people do not have to follow the 40 hours per week limitation or keep to a 5 day workweek. There are no restrictions on extending the work day beyond 8 hours, or even beyond 12 hours, nor does the employer have to pay additional allowances (50%) for overtime, night shift (10:00 pm to 6:00 am) or holiday work.

4) Annual paid leave When a worker at a workplace employing at least five people has worked continuously for one year, 15 days of annual paid leave are granted, but workers at workplaces ordinarily employing fewer than five people are not guaranteed any paid, non-statutory holidays. A worker at such workplaces must get permission to take a day off, and the employer can deduct one day’s salary.

3. Domestic Workers Employed by a Company

(1) Background

“Domestic worker” refers to a person paid to engage in work that runs a particular home as a housekeeper, a cleaner, a nanny, a butler, etc. As “domestic work” exclusively involves housekeeping related to an individual’s private life, it is not preferable for the nation to intervene in and audit working hours or wages, which is why domestic workers are excluded from the Labor Standards Act. Therefore, even though a domestic worker for a company president is employed by the company, the LSA is not applicable. However, in cases where a worker is employed by a company and is covered by company regulations, but was assigned to work as a gardener, guard, butler, driver, etc. at the company president’s house, the situation is different. I would like to review some cases that deal with this issue.

(2) Domestic worker not covered by the Labor Standards Act

This labor case involved an application for remedy for unfair dismissal, but was dropped as the domestic worker was not covered by the Labor Standards Act. The ruling stated: “Even though this worker claimed he applied for a position posted by the company, his workplace was the summer house owned privately by the company president, and he was employed by the president and her husband. Caretaking of the summer house was not related to the company’s main business of construction. In addition, the worker has not done anything to contribute to the profit gaining activities of the company. In light of these facts, this worker, privately employed by the employer, is considered a domestic worker to which Article 11 of the LSA applies. It is therefore not necessary to review the facts of the dismissal or its justification.” Gyunggi Labor Relations Commission: 2012 buhae 1130.

(3) Domestic worker covered by the Labor Standards Act

In looking into the background to the worker beginning to work at the CEO’s house, it was found that he had been employed by the company to work in the Management Department, and then was immediately assigned to work at the CEO’s house. Since that time, the company had managed the worker’s general matters regulated by labor law such as wages, service regulations, and payment of severance pay. The company had also handled the worker’s social security insurance and other income deductions. Even though the type of work was at the discretion of the CEO, the worker still belonged to the company organization. This worker is clearly different from a worker hired independently by an individual as a private housekeeper, driver, or gardener. Accordingly, the decision by the Employee Welfare Corporation to reject the family’s application for the survivors’ pension because of the worker’s supposed status as a domestic worker was inaccurate. Industrial Accident Compensation Insurance Review Committee 2004-910, Sept. 14, 2004.

(4) Judgment

A review of these two cases reveals two things: 1) In cases where a worker is employed by a company and is exclusively engaged in housekeeping duties, the worker shall be regarded entirely as a housekeeper excluded from coverage by the Labor Standards Act; 2) However, in cases where a worker was employed by the company and assigned to the company president’s house as a guard, exclusive driver, gardener, etc., that worker is likely considered to be covered by the LSA. In light of this, it is necessary to consider the worker’s job characteristics, job scope, and work relations with the company in deciding whether the LSA applies or not.

4. Conclusion

Employees of workplaces ordinarily employing fewer than five people are at times excluded from or have restrictions on their coverage by the Labor Standards Act. Such restrictions or exclusion from basic labor rights normally granted to other workers have resulted in poorer working conditions for them in terms of dismissal, disciplinary action, restrictions on working hours, etc. To protect their minimum labor rights, protections in three more areas shall be given: restrictions on working hours, allowances for suspension of business due to the reasons attributable to the employer, and additional allowances for extended work, night time work, and holiday work. As for domestic workers, although they are workers (since they work for payment), because they work exclusively for a particular house as housekeeper, butler, gardener, etc., they are not considered as workers covered by the LSA. However, in cases where a domestic worker is assigned to a particular director’s house, if the company manages his/her payment etc., and supervises his/her work, the person can be regarded as a worker under the LSA. This requires an understanding by employers of the concrete details of the work performed by the domestic worker, regardless of his/her title of “domestic worker”.