Chapter 2 Working Hours and Extended Working Hours

- Case Study 2-1 Driver of Director Paid Less than Statutory Allowances

-

The exclusive driver of a director (hereinafter referred to as “the Employee”) of Company A (hereinafter referred to as “the Company”) resigned after serving approximately 6 years, and filed a petition to the Ministry of Employment & Labor for severance pay owed him, as well as statutory allowances for overtime, night, and holiday work, which were significantly different than what he received from the Company.

The Employee was hired by the Company on September 29, 2005 as a temporary employee and driver of the director’s car. His employment contract was renewed every year for four years, after which the Company made him a dispatched employee of another company due to the limitations on continued employment of fixed-term employees, and had him continue doing the same duties. The Employee resigned on August 13, 2011, after working two additional years. The reason the Employee filed the petition is because the Company just paid a fixed allowance for overtime exceeding the fixed overtime and holiday work. These fixed allowances were much lower than the allowances calculated by the Labor Standards Act, and the same situation existed for his severance pay.

The legal issues in this labor case were 1) overtime and holiday work allowances for an intermittent worker, 2) method used in calculation of overtime, night, and holiday work, 3) who was the employer responsible for payment of overtime for him as a dispatched employee, 4) the statute of limitations regarding unpaid wages, and 5) the method used in calculating average wages for severance pay.

1. Details of the Petition

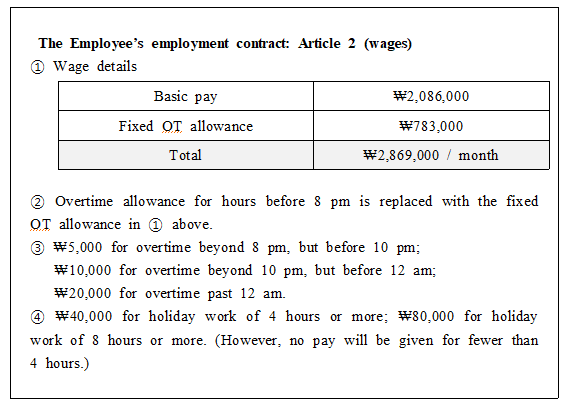

(1) The Company’s fixed allowance and statutory requirement

As the director’s exclusive driver, the Employee’s working hours were according to the director’s work schedule. While employed, the Employee constantly worked overtime hours exceeding the contractual working hours of 8 hours per day and 40 hours per week, as stipulated in the employment contract. Working hours were stipulated as between 9 am and 6 pm, with a one hour recess during that time. Wages included basic pay and a certain allowance which was set to cover a fixed overtime of two hours every day. For overtime, night, and holiday work, a fixed allowance was paid of a minimum ₩5,000 (for daily overtime exceeding 2 hours) and a maximum ₩80,000 (for holiday work exceeding 8 hours).

The calculation of statutory allowance according to the Labor Standards Act is not to pay a fixed allowance stipulated in the employment contract, but to multiply the number of overtime and holiday working hours by ordinary hourly wages, and then add 50% as the statutory allowance.

Related examples follow: Working details were recorded in “car operation details” and calculated by the Company.

1) Regular work day: Arrived at 6 am on Wednesday, Nov 19, 2008. Started driving and finished at 2 am the following day for a total of 11 hours overtime and 4 hours night work.

Payment from the Company: ₩20,000 fixed overtime allowance.

Statutory allowance: 150% of 9 hours excluding 2 hours already included in the fixed OT allowance, plus 50% of 4 hours for night work. That is, 13.5 hours for overtime and 2 hours for night work equal 15.5 hours. Ordinary hourly wages of ₩9,980 x 15.5 hours = ₩154,690. As ₩20,000 was already paid, ₩134,690 is the amount due.

2) Saturday work Calculation of ordinary hourly wages: Monthly ordinary wage (₩ 2,086,000) / Monthly contractual working hours (209) = ₩9,980.

: Arrived at 7:30 am on Saturday, May 30, 2009, and finished working 12:20 am that night for a total of 16 hours overtime and 2.5 hours night work.

Payment from the Company: Regarded as holiday work exceeding 8 hours, so

₩80,000 was paid as a fixed allowance.

Statutory allowance: 150% of 16 hours, plus 50% of 2.5 hours for night work. That is, 24 regular hours for the overtime and 1.25 (1¼) hours for night work equals 25.25 hours. Ordinary hourly wages of ₩9,980 x 25.25 hours = ₩251,995. As ₩80,000 was already paid, ₩171,995 is due.

3) Sunday work: Arrived at 5:30 am on Sunday, September 20, 2009, and finished working at 10:30 pm for a total of 16 hours holiday work, 8 hours for overtime and 30 minutes for night work.

Payment from the Company: ₩80,000 in fixed holiday allowance.

Statutory allowance: 150% of 16 hours for holiday work, 50% of 8 hours for overtime, and 50% of 8 hours for night work. That is, 24 regular hours for holiday work, 4 hours for overtime, and 0.25 hours for night work for a total of 28.25 hours. Ordinary hourly wages of ₩9,980 x 28.25 hours = ₩281,935. As ₩80,000 was already paid, ₩201,995 is the amount due.

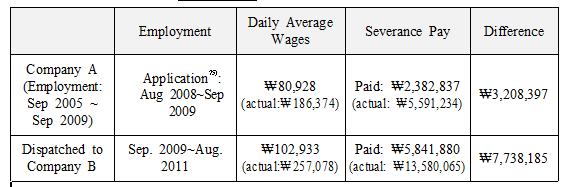

(2) Calculation of average wages to calculate severance pay

The Employee’s employment contract stipulates, “30 days’ average wages as severance pay are payable to employees who serve one year or more, upon contract expiry.” In calculating average wages, the Company included only the basic pay and fixed OT allowance into the total amount of wages received for the three months prior to the date of resignation, excluding other allowances. In addition, the Company also paid his severance pay every year when his employment contract was renewed. The average wages calculated under the Labor Standards Act shall include not only basic pay and fixed OT allowance, but also meal and statutory allowances like overtime, night work, and holiday work. The Employee requested that the excluded allowances be calculated as part of his severance pay.

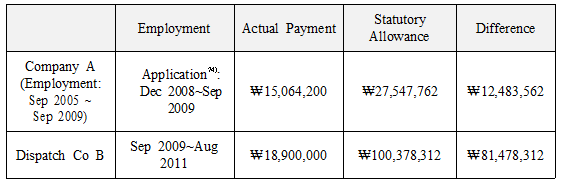

(3) Details of unpaid wages

1) Unpaid statutory allowances: ₩93,961,874

2) Unpaid severance pay: ₩10,946,582

3) Total amount claimed: ₩104,908,456

2. Major Issues

(1) Overtime and holiday work allowances for an intermittent worker

Generally, drivers of directors have long working hours, with the majority of these hours spent waiting, so it is not really fair to consider a driver’s working hours as equal to a regular employee’s working hours. Due to this, companies who receive permission can be exempt from paying additional overtime and holiday work allowances. However, the Company in this case did not receive an exemption from the Minister of Employment and Labor, so statutory allowances cannot be excluded, and the driver’s allowances shall be recalculated according to the Labor Standards Act.

【Labor Standards Act】Article 63 (Exceptions to Application)

The provisions as to working hours, recess, and holidays shall not be applicable to workers who are engaged in any of the work described in the following subparagraphs: 3. surveillance or intermittent work, for which the employer has obtained the approval of the Minister of Employment & Labor.

【Administrative Guideline】Kungi 68207-1215, Oct. 2, 2003

Even though the characteristics of the work make it surveillance or intermittent work, if the employer has not obtained approval from the Minister of Employment and Labor, provisions in the Labor Standards Act concerning working hours, recess, and holiday shall apply.

(2) Method of calculation for overtime, night, and holiday work

The Company paid fixed allowances for the driver’s overtime, night and holiday work. However, until obtaining approval for exemption “for a surveillance or intermittent worker”, the Company shall pay additional statutory allowances for overtime, night and holiday work exceeding the legal standard working hours just like it would for ordinary workers. In cases where the Company pays fixed allowances for overtime, night and holiday work, if the fixed allowances exceed the statutory allowances, it is allowed. However, if the fixed amount is lower than statutory allowances, the Company shall pay the additional amount.

(3) Employer responsible for payment of overtime for dispatched employees

Article 34 of the Act on the Protection, etc. of Dispatched Workers (Special Cases relating to Application of Labor Standards Act) regulates that the sending employer is regarded as the employer responsible for matters concerning employment and wages, and that the using employer is regarded as the employer for matters concerning working hours. Accordingly, the sending employer directly determined and paid such wages as monthly salary, meal allowances and the fixed overtime allowance stipulated in the Employee’s employment contract, but the using employer paid the Employee additional variable overtime allowances exceeding the fixed overtime allowance, as decided by the Company’s regulations (according to its car operation records). Therefore, the using employer shall be responsible for statutory allowances for additional work performed as requested by the Company.

(4) Statute of limitations regarding unpaid wages

According to Article 49 of the Labor Standards Act (Prescription of Wages), as the statute of limitation to exercise a claim for wages is three years, the Employee can claim his unpaid statutory allowances and severance pay for the past three years, and not the past six.

(5) Method of calculating average wages for severance pay

Severance pay is calculated based on average wages, and on the total amounts paid in meal, overtime, night, and holiday work allowances, but the Company intentionally excluded these.

1) As long as the meal allowance is paid periodically and uniformly, this cannot be pure welfare or a bonus expressing favor, but shall be regarded as money characteristic of wages paid as remuneration for labor service.

2) As the total wages calculated for average wages are any money and valuable goods an employer pays to a worker for his/her work, what the worker receives continuously and regularly, and what the employer has to pay according to the collective agreement and rules of employment, regardless of how such payments are termed, the holiday work allowance shall be included [in calculation of severance pay]. Supreme Court 91da5587, Apr. 14, 1992.

3) As the overtime allowance is not money paid under friendly and favorable conditions, but rather, is remuneration that the employer has to pay for an employee’s work, regardless of its label, the overtime allowance shall be included into average wages when calculating severance pay. Seoul District Court 2005na175, May 26, 2005.

3. Conclusion

This petition case for unpaid allowances is a case of wages that were unpaid due to the HR manager’s ignorance of labor law and lack of work-related preparation. The Company concluded this case by paying the difference between what they had already paid in fixed amounts and the statutory allowances occurring due to actual work. Through this case, the Company learned to recognize the fact that wages remained unpaid from a neglect to follow the procedural rules and calculation methods under labor law, even though the Company paid enough in regular wages.

This case happened because the Company was used to paying fixed allowances for overtime, night and holiday work over a long period of time, due to the convenience of calculation. 1) If the Company had adjusted its wages by reducing the basic pay and increasing fixed allowances, or 2) if the Company had previously submitted to the Labor Office “an application for exemption for surveillance and intermittent workers” and received the necessary approval while keeping the current wage system, there would have been no problem related to unpaid wages. Accordingly, companies are required to understand the wage rules in the Labor Standards Act first, before establishing their wage systems.