Chapter 19 The Four Types of Social Security

- Section 3: National Pension Plan

-

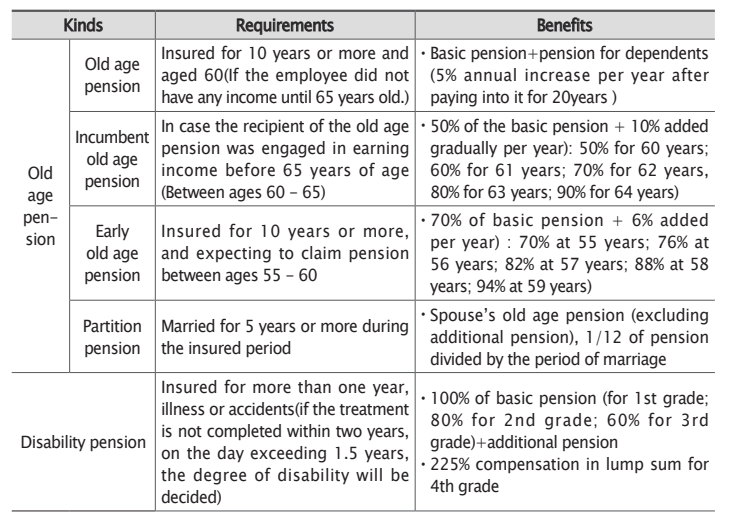

I. Nation Pension System

The National Pension Scheme is a system that pays old-age pensions to citizens who reach a certain age, or pays the pension to the citizen’s family if the pensioner is disabled or dies(Article 1 of the National Pension Act, or NPA). The National Pension Scheme was enacted on January 1, 1988, when the NPA came into effect. Initially, it applied only to workplaces hiring 10 or more workers, but then gradually expanded to every company(Article 6). However, civil servants, soldiers, and private school workers subject to the Civil Service Pension Act, the Military Pension Act, and the Private School Pension Act, respectively, are excluded from membership. The National Pension Plan is divided into workplace subscribers and regional subscribers, and it is mandatory for workplaces that use one or more workers at all times to be subscribed. Excluded from workplace subscribers are the self-employed who do not employ workers, daily workers employed for less than one month, non-employed workers, or part-time workers who work less than 60 hours a month. Premiums are in proportion to income, with 50% borne by the worker and 50% by the employer.24) The types of benefits under the NPA include old-age pension, survivor’s pension, disability pension, and lump-sum refund.25)

II. Application of National Pension and Premiums

1. Scope of application

All persons residing in the country who are between the ages 18 and 60 are eligible for national pension. However, civil servants, soldiers, employees of private schools, or other

employees described in the Presidential Decree are ineligible for the pension, under the Civil Servants’ Pension Act, the Veteran’s Pension Act, or the Private School Teachers Pension Act.

The scope of application is divided between the company and individual. For companies ordinarily hiring one or more workers, application for national pension is mandatory.

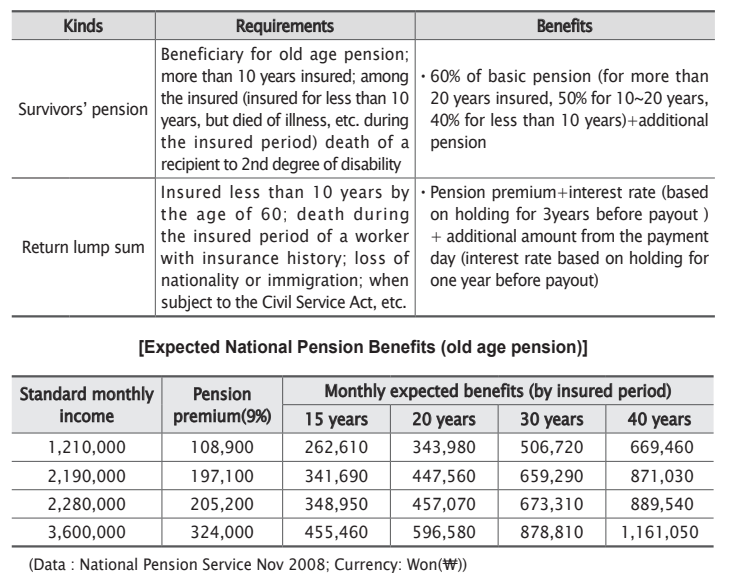

2. Premium rate

The National Health Insurance Corporation collects from each company a total premium of 9% each month as private and company burden, collecting 4.5% of the standard wage from the employee and the employer each.

III. Benefits of the National Pension

National pension benefits are calculated in respect to basic pension and additional pension, and rendered by the National Pension Corporation at the request of the beneficiary.

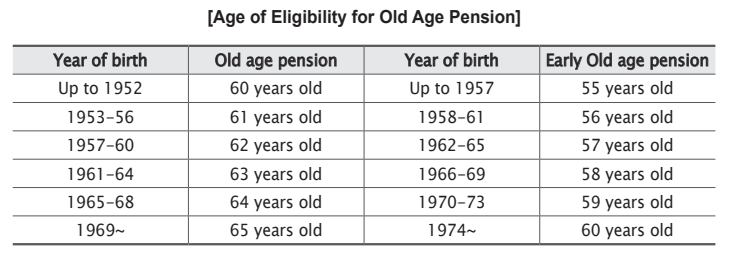

IV. Eligible Age Extended for Old Age Pension

The eligible age to receive old age pension is currently 60(55 for early old age pension). However, the age of eligibility will is being extended every five years between 2013 and 2033. This is designed to maintain financial stability of the pension scheme as Korean society ages.

[Age of Eligibility for Old Age Pension]