Chapter 19 The Four Types of Social Security

- Section 2: Industrial Accident Compensation Insurance (2/2)

-

VI. Premium Rates

1. Premiums

Premium rates are directly related to the insured’s premium. To ensure fairness of the premium, every June 30, the rates are determined(according to the category of business) under the potential rate of accidents based upon the ratio of the total insurance benefits to the total wages for the past three years.

The premium rate applies as follows:

- A single premium rate shall be applied in the same workplace.

- In a workplace that operates at least two businesses with different rates, the principal

business shall be determined as follows:

① The business with the larger number of workers;

② If there is an equal number of workers, or the number of workers cannot be determined, the business with the higher total wages; and

③ If it is impossible to determine the principal business by the 1) or 2) above, the business with the higher sales of manufactured products or services.

2. Adjustment of premiums in exceptional cases

Applying the same rate for identical industries is designed to create a balance between employers taking significant steps to avoid occupational accidents and employers who do not. In cases where the insurance benefits paid during the previous three years exceeds 85%, or is less than 75%, of the premiums for the same years, the applicable rate for that industry shall be adjusted up or down by 20% up to a maximum of 50%. This new rate will be applied at the beginning of the following year.

(1) Application of premiums

This special premium rate applies to companies that hire 30 employees or more, excluding those in construction or logging. However, as of July 30, which is the period when the premiums for individual companies are calculated, if the type of industry to which the premiums apply has changed within the previous three years, this special premium application shall not be reflected.

(2) Method of calculation

① Ratio of benefits vs. premiums = total insurance benefits paid during the previous

three years / total premiums paid during the previous three years 100

② The insurance benefits paid for unavoidable reasons due to occupational accidents by

a third party, natural disasters, power outages, etc. shall be excluded in calculation.

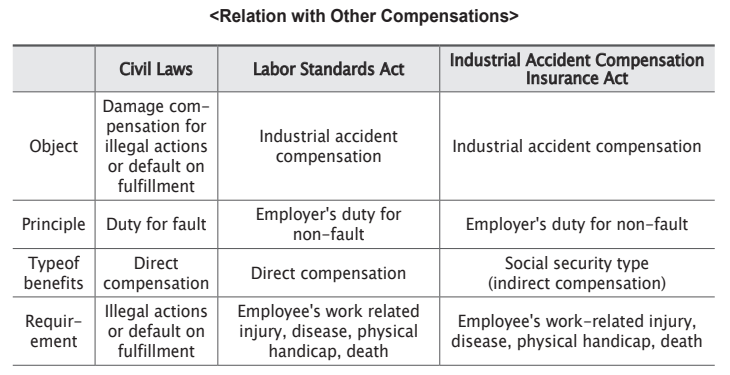

VII. Compensation Procedures and Relation to other Compensation

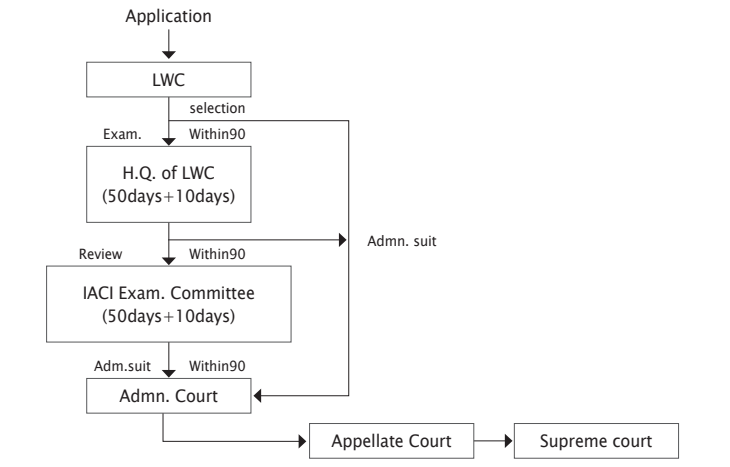

1. Compensation procedures under the IACI Act

As with a relief application for remedy against unfair dismissal, in the event that the application is not accepted at a branch office of the Labor Welfare Corporation, the employee may bring an administrative suit without requesting an examination to the headquarters of the Corporation or a review by the IACI Examination Committee. In general, the request for an examination and request for review are processed rapidly and economically, but the initial applications are usually denied, whereas administrative suits are more commonly accepted, though they take much longer and cost more.

Application

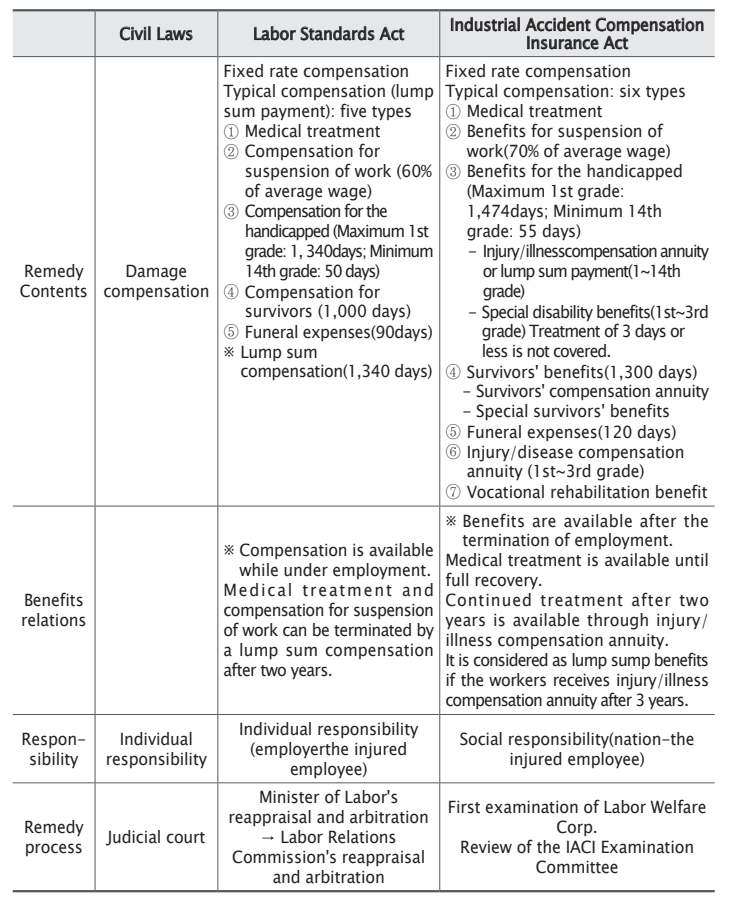

2. Labor Standards Act

If the employee concerned receives insurance benefits from the IACI, the employer may be excused from his/her responsibilities to the Labor Standards Act. With the exception of such accidents requiring less than a 4-day treatment at a hospital not covered by the IACI, the employee shall not receive compensation according to the Labor Standards Act until the payment status for the insurance benefits is determined. An employer shall not dismiss any employee during the period of medical leave for an occupational injury or illness, nor 30 days thereafter.

However, if an employee who has received medical care benefits for the last three years, receives the injury-disease compensation annuity, the employer concerned may terminate his/her service upon the fourth year as prescribed in Article 84 of the Labor Standards Act(Article 80(4) of the IACI Act). In this case, the period of treatment of 3 years shall be calculated into the severance pay.

3. Damage compensation according to the Civil Act

If a beneficiary has received benefits under the Labor Standards Act or the IACI Act, the employer shall be exempt from responsibility for the same accident within the amount paid concerning the damage compensation by the Civil Act. However, if the beneficiary has received, under the Civil Act or other Acts, any amount of money equivalent to the insurance benefits as prescribed by this Act for the same cause, then the company shall not provide insurance benefits as prescribed by this Act within the limit of the amount calculated(Article 80(3) of the IACI Act).

Civil compensation for damages refers to all damages the victim suffered from proximate causes related to the company’s negligence. Judicial ruling divides such coverage of compensation for damages into three parts: direct, indirect and emotional damage. Direct damage due to occupational fatality would be medical and funeral expenses, while indirect damages would include the lost monthly wages for the period from death to retirement age and the lost severance pay due to early retirement; emotional damages would be compensated by payment for consolation. General speaking, if the employee is younger or is less at fault than the employer, it is better for the family to choose civil compensation, as civil compensation for damages may far exceed the amount claimed for industrial accident insurance compensation.

4. Industrial accident compensation and claims for criminal damage compensation

If there exists a direct offender and victim relationship in an occupational fatality, the surviving family can seek compensation for criminal behavior against the individual offender.

The company may be the target of an intensive audit by the labor inspector for compliance with occupational safety rules according to the Occupational Safety and Health Act, if the workplace had a serious industrial accident. If, during this audit, the company is found to have violated any of the safety rules, it would have criminal charges filed against it.

Article 167 (Penal Provisions) of the Occupational Safety and Health Act: A person who has caused the death of a worker in violation of Article 38 (Safety Measures)

(1) through (3), or Article 24 (Health Measures) (1) shall be punished by imprisonment for not more than seven years or a fine not exceeding 100 million won.

5. National pension

Even if an employee is compensated for an industrial accident through the Industrial Accident Compensation Insurance or the Labor Standards Act, he/she can also demand a survivors’ pension or disability pension. If the beneficiary for the survivors’ pension or disability pension, according to the Article 113 of the National Pension Act, has already received payment under other laws, then only 50% of the survivor’s pension(Article 68) and disability pension(Article 74) shall be granted.

6. Automobile insurance

If an employee is injured in a traffic accident while working, he/she can receive compensation from either Industrial Accident Compensation Insurance or the automobile insurance. Accordingly, the employee can select the more favorable insurance after considering the cause of the accident. Generally, if the employee is elderly or holds the greater fault, it is better to choose Industrial Accident Compensation Insurance, given that automobile insurance deducts payment according to the degree of fault.

7. Other insurances

Other insurance benefits such as survivors’ pension, unemployment benefits, etc. from life insurance, damage insurance, fire insurance, or mutual aid insurance are remunerations for the deposits paid in advance. Given that additional benefits are provided for other reasons by a separate contract, benefits from the Industrial Accident Compensation Insurance Act shall not be deducted.