Chapter 19 The Four Types of Social Security

- Section 1: Employment Insurance (2/2)

-

IV. Projects Promoted through Employment Insurance

Employment insurance projects are divided into unemployment benefits, employment

security, and vocational skills development projects.

1. Unemployment benefits

(1) Employees eligible for unemployment benefits

Employment benefits are paid to unemployed persons who satisfy the following two criteria: employees who had to leave a job involuntarily for reasons such as dismissal for managerial reasons, expiration of contract period, etc. after having worked at least 180 days during the last 18month period, and unemployed people who are actively seeking to become reemployed. However, unemployment benefits shall not be given in cases where an employee has left his/her job to start another job or become self-employed or in cases where the employee is separated from employment following the advice of the employer or dismissed due to reasons attributable to him/herself.

※ Cases dismissed due to critical reasons attributable to employee

① The employee is sentenced to imprisonment (without being assigned prison labor or

more severe punishment) for violating the Criminal Act or laws relating to employment;

② The employee has, on purpose, caused a considerable hindrance to the business or inflicted any damage to property due to embezzlement, disclosure of corporate secrets, damage to property, etc.; and

③ The employee has been absent from work for a long time without due notice or

justifiable reasons.

* If an employee to whom any of the above items apply resigns voluntarily at the employer’s advice, he/she shall not be eligible to receive unemployment benefits.

Unemployment benefits are paid to an unemployed person when he/she reports unemployment and is recognized as an eligible recipient, and when he/she begins seeking reemployment. Therefore, this beneficiary process requires the recognition of unemployment status and evidence to prove the applicant is actively seeking reemployment for a unit period of three to four weeks. Therefore, in principle, a reemployed employee is not eligible for unemployment benefits. If an eligible recipient is employed in a job that is deemed certain to keep him/her employed for at least six months, or if an eligible recipient is deemed certain to run his/her own business for six months or more, then the reemployed person can get a certain portion(1/3 ~ 2/3) of the benefit still left as an early reemployment incentive.

In cases where an employee resigns from a company voluntarily by submitting a resignation letter or changing occupation, becoming self-employed, or going back to school, unemployment benefits shall, in principle, not be given. However, the employee can receive unemployment benefits under the following special circumstances:

◈ Reasons for unemployment benefit acceptable for eligible beneficiary

(Employment Insurance Decree Regulation (Article 101(1)–Table 2, 2022.6.30.)

1. If any of the following happens within a period of two months or more within one year prior to the date of unemployment:

(1) The actual working conditions are lower than the working conditions presented at the time of hiring or

the working conditions generally applied after hiring;

(2) The payment of wages is delayed;

(3) If the wage paid for prescribed work falls below the minimum wage under the Minimum Wage Act;

(4) If the restrictions on extended work in Article 53 of the Labor Standards Act are violated;

(5) Due to workplace closures, less than 70 percent of average wage is paid.

2. If the employee received unreasonable discrimination on the grounds of religion, sex, physical disability,

union activities, etc. at the workplace;

3. If the employee was unwillingly subjected to sexual harassment, sexual assault, or other sexual bullying in the workplace;

3-2. In case of workplace harassment pursuant to Article 76-2 of the 「Labor Standards Act」

4. The business is certain to go bankrupt or close, or large-scale layoffs are planned;

5. If the employee is advised to terminate employment by the employer due to any of the following conditions, or if he or she leaves the job due to the recruitment of early retirement applicants pursuant to an employment adjustment plan caused by the inevitability of staff reductions:

(1) Transfer, acquisition, merger of business;

(2) Partial business abolition or business conversion;

(3) Abolition and reduction of organization by reorganization;

(4) Changes in work patterns due to the introduction of new technologies and technological innovations;

(5) Deterioration of management, congestion of human resources or other similar reasons.

6. If the employee experiences difficulties in commuting due to any of the following reasons (at least three hours are required to get to the workplace and back by ordinary means of transportation):

(1) Relocation of business;

(2) Transfer to another business location;

(3) Transfer of residence for the purpose of cohabiting with a spouse or relatives in need of support;

(4) Other unavoidable reasons for the difficulty.

7. Due to the circumstances of the company, the employee could not take vacation or temporary leave and terminated employment during the period of more than 30 days of supporting his or her parents or cohabitating relatives for sickness or injury;

8. The employee works at a workplace where, despite a “serious accident” occurring in accordance with Article 2, Item 2 of the Occupational Safety and Health Act, and a correction order received from the Minister of Employment and Labor, the company has taken no corrective actions within the given period and employees are exposed to the same danger;

9. Termination of the employee’s employment is objectively recognized based on the opinion of a doctor or the employer, etc., due to an insured worker being unable to perform given task(s) due to a lack of physical strength, physical or mental disability, illness, injury, loss of sight, hearing or tactile sense (job transfers and temporary leaves are also allowed if they are due to company circumstances);

10. The insured worker is unable to continue work due to pregnancy, childbirth, childcare of a child under the age of 8 or up to second grade in elementary school (including an adopted child), or the employer cannot allow vacation or temporary leave for the employee to fulfill his obligatory service under the Military Service Act;

11. If the details of the business of the employer become illegal due to enactment or amendment of laws and ordinances or produces or sells goods or services not illegal at the time of employment, but now prohibited by laws or regulations;

12. The employee reaches retirement age or the employee’s contract expires;

13. In addition, it is objectively recognized that other workers in the workplace under the circumstances of

the insured person may have resigned.

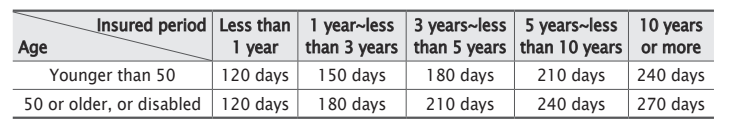

(2) Amount of unemployment benefit

The unemployment benefit is 60% of the average wage prior to separation within the range

of 100 to 270 days in accordance with the age and insured period as of separation time.

⇨ Maximum amount: 66,000 won per day(As of 2025)

⇨ Minimum amount: daily contractual working hours x 80% of daily minimum wage; However, if the lowest amount calculated(based upon 80% of the minimum wage) is less than 64,192 won, the amount is 64,192 won.

⇨ Number of days unemployment benefits can be received

Even though an unemployed person is eligible for unemployment benefits, he/she cannot receive them if 12 months have passed from the initial date of unemployment. These 12 months are called the period of benefit payment. As unemployment benefits cannot be paid if the period of benefit payment expires, an unemployed person shall apply for benefits with the Employment Support Center without delay right after termination of employment.

※ Reasons for extension of payment period (maximum extension is 4 years)

- Injury or illness of the recipient (excluding injuries or illnesses for which injury and

disease benefits are being paid);

- Injury or illness of the recipient’s spouse or lineal ascendants or descendants;

- Mandatory military service under the Military Service Act;

- Detention or execution of sentence on criminal charges; and

- Pregnancy, childbirth, and childcare (limited to within 3 years after the birth of a child).

(3) Payment procedures for unemployment benefits

To receive unemployment benefits, immediately upon termination of employment, the unemployed person shall visit the Employment Support Center in his/her location with identification documents, such as a residence card or driver’s license, and report unemployment. The report of unemployment shall include an application for work and an application for the recognition of eligibility for benefit. The head of the Employment Security Office shall then notify the applicant of its decision within 14 days.

1) Recognition of unemployment

Recognition of unemployment means that the head of an Employment Security Office recognizes that the applicant has become unemployed and is actively seeking reemployment during a certain recognition period of unemployment, and is eligible for unemployment benefits. An eligible recipient shall present him/herself on the date of recognition of unemployment designated by the head of the Employment Security Office over the course of one to four weeks from the date the unemployment was reported, and shall report the efforts he/she has made to become reemployed, and the head of the Employment Security Office shall recognize his/her unemployment based upon the details of the report. Eligible recipients cannot receive unemployment benefits if they were not recognized as being unemployed because of a failure to report to the Employment Security Office on the day(s) required.

2) Actively seeking to become reemployed

Eligible recipients shall actively seek to become reemployed(i.e., get another job) in accordance with the reemployment action plan completed on the first day of unemployment so that they can be recognized as being unemployed. Here, “actively seeking to become reemployed” means the unemployed person has taken action such as submitting job applications or participating in job interviews, and/or made efforts to become self-employed. Job-seeking activities also include submission of job applications by mail, fax or email, participation in job interviews with recruiters at a job fair, or attending occupation guidance programs conducted by the Employment Security Office.

(4) Fraudulent receipt of unemployment benefits

Unemployment benefits are payable when an applicant is recognized as an unemployed person by the head of an Employment Security Office and actively seeks to become reemployed during the recognition period of unemployment. It is illegal to receive unemployment benefits through false or fraudulent methods.

※ The most common cases of illegally receiving benefits involve a person not reporting

reemployment during the recognition period of unemployment or reporting it using fraudulent information, or making a false report regarding his/her wages while employed or the reason(s) for termination.

If it is found that a person has received unemployment benefits through illegal methods,

he/she shall refund the benefit received and, as a penalty, pay an additional, identical amount equivalent to the illegally received benefit. Further, his/her unemployment benefits will stop and the person concerned could face criminal prosecution. If a company manager was involved in perpetuating the illegality, the employer shall also share joint responsibility with the person.

1) A small illegal benefit can be forgiven only once.

2) Criminal punishment can be pursued when a person violates the law twice, where two people or more collaborate and receive benefits illegally, and in cases where a person rejects the requests to repay the illegally received benefits despite repeated demands from the Employment Security Office.

3) In cases where illegal benefits were paid due to a falsified description on the company’s confirmation of severance, an additional fine(2~3 million won) will be levied against the company.

2. Employment security project

It is important for the employer to be familiar with the contents and prepare in advance to receive these subsidies.

These subsidies are available to the employers who, instead of cutting their workforce, retain jobs or recruit unemployed people, so as to increase job security for incumbent employees while promoting employment of disadvantaged persons.

(1) Subsidy for employment adjustment

When the employer adjusts employment through suspension of business, reduction of working hours, training, suspension of work, and personnel rearrangement, the Ministry of Employment and Labor provides a subsidy to the employer if he/she maintains employment of the employees concerned(Article 21 of the EIA).

(2) Subsidy for employment creation

The Minister of Employment and Labor may provide support to employers who have expanded employment opportunities by improving employment environments, changing work arrangements, etc(Article 20 of the EIA).

(3) Subsidy for employment promotion

① Subsidy for employment promotion: older workers, those with disabilities, young people, female heads of households, women who have just given birth, long-term unemployed, ② Older workers: employing many older people, extending retirement age, continuing employment after retirement, ③ Subsidy to promote childcare leave and subsidy for hiring replacement personnel, ④ Subsidy for reducing working hours during childcare period, ⑤ Nursery, ⑥ Maintaining allowance for the wage peak system, ⑦ Subsidy for continuous employment after childbirth, ⑧ Employment for construction workers

3. Vocational skills development project

Financial backing is offered to employers who give vocational training to their employees and employees who take up training for the purpose of self-development.

(1) Support for the employer

① Support for vocational skills development training, ② Support for paid-leave training

③ Support, etc., for vocational skills development training facilities, ④ Support for vocational skills development of construction workers

(2) Support for the employee

① Support for tuition, ② Loan for tuition, ③ Re-employment training for the unemployed, ④ Support for government-commissioned training expenses