Chapter 19 The Four Types of Social Security

- Section 1: Employment Insurance (1/2)

-

The four statutory insurances of Korea are employment insurance, industrial accident compensation insurance, national pension, and national health insurance. 1) Employment insurance, started in 1995, is to provide income in case of unemployment, to promote employment, and to help develop vocational skills of employees. 2) Industrial accident compensation insurance, which took effect in 1964, is aimed at supporting employees and their families with costs associated with occupational injury, disease, disability, or death. 3) The national pension plan, which began in 1988, is to provide a pension for people during retirement, invalidity, or death of a spouse. 4) The national health insurance plan, which began in 1977, aims at preventing, diagnosing, and treating people’s injuries and illnesses.

I. Employment Insurance System

Employment insurance includes the traditional social security insurance that provides unemployment benefits to unemployed employees, in addition to employment security insurance, which promotes re-employment through government vocational guidance, which exists to improve employee job security, the employment structure, employee vocational skills development, etc.

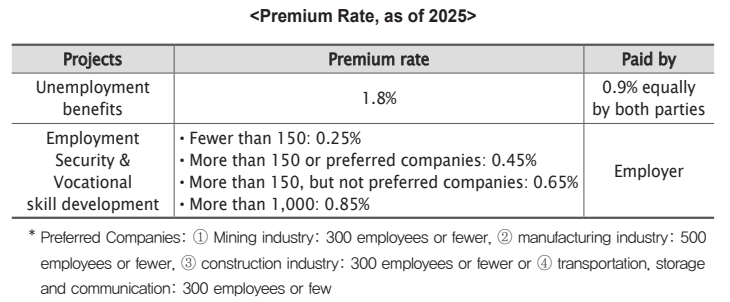

Employment insurance premiums are classified into unemployment benefits and premiums for employment stability and vocational skills development projects.

Unemployment benefit premiums are borne by both workers and employers, while employers are responsible for employment security and vocational skills development projects(Article 6 of the Employment Insurance Act, hereafter, the EIA).19) Unemployment benefits are payable only when a worker is involuntarily unemployed and seeking work.20)

II. Operational Structure of the Employment Insurance System

1. Scope of application

(1) Applicable businesses

In principle, employment insurance shall be applicable to any business or workplace that ordinarily hires an employee, but the following businesses shall be restricted based upon the size of the business. Even if the business is not eligible for employment insurance, the business owner can independently apply for insurance with the consent of the majority of employees and the approval of the Minister of Employment and Labor.

Businesses ineligible for employment insurance are as follows:

① Businesses engaged in farming, forestry, fishing and hunting, which ordinarily hire 4

workers or fewer;

② Housekeeping businesses; and

③ Construction projects estimated to cost less than the amount prescribed annually by the Minister of Labor.

※ Prescribed amount in 2025: Less than 20 million won, provided that the total size of the building construction is 100㎡ or less; or the total size of the repair construction is 200㎡ or less, done by non-housing companies under the Housing Construction Promotion Act or non-construction companies under the Construction Industry Standards Act.

(2) Applicable employees

Employment insurance shall be applicable to all employees in principle, but the following employees shall be excluded:

① Those who are employed beyond 65 years old

② Daily workers whose contractual working hours are fewer than 60 hours per month(15 hours per week)

③ Government employees under the State Public Officials Act and the Local Public Officials Act

④ Those subject to the Private School Teachers Pension Act

⑤ Special post office staff who are referred to in the Special Post Office Act

⑥ Seamen under the Seamen Act; and

⑦ Foreign workers without residence permits(foreign workers who have residence permits may be insured independently).

2. Report of establishment/termination of insurance relationship

The business owner shall report to the Minister of Employment and Labor within fourteen days from the establishment date of the employment insurance, and within fourteen days from the date of discontinuation/suspension of the business.

3. Report on acquisition or loss of insurance qualification

The business owner shall inform the Employment Security Office with jurisdiction over the business concerned within 14 days of the acquisition or loss of their employment insurance qualifications.

III. Premium Rate

1. Principle of premium charge

Premiums are charged according to the unemployment benefits premium rate and the employment security & vocational ability development premium rate. The unemployment benefits premium is shared equally between employee and employer, whereas the employment security and vocational skills development premiums are charged only to the employer.

2. Premium rate

* Preferred Companies: ① Mining industry: 300 employees or fewer, ② manufacturing industry: 500 employees or fewer, ③ construction industry: 300 employees or fewer or ④ transportation, storage and communication: 300 employees or few

3. Calculation and payment of premiums

The premium is calculated by multiplying the employee’s total annual income by the premium rate of the employer. The business owner must pay the premium plus the amount the employee is being charged; unemployment benefit premiums charged to the employee shall be withheld from monthly pay.

The Employer shall report each individual employee’s total income data for all employees for the previous year to the branch office of the Labor Welfare Corporation by the end of February every year. Then, the Labor Welfare Corporation calculates and determines the employment insurance premium and the National Health Insurance Corporation levies its premium invoice along with other social security insurance premiums to each company.