Chapter 3 Wages

- Section 1: Wages and Labor Law - Ⅲ-1. Ordinary Wage

-

1. Understanding Ordinary Wage61)

(1) Concept of ordinary wage

The term ‘ordinary wage’ means hourly wage, daily wage, weekly wage, monthly wage, or subcontract wage determined to be paid in periodic or lump sums to the worker for prescribed or whole labor.62) That is, ‘ordinary wage’ means the wage determined to be paid periodically and uniformly regardless of the number of actual work provisions or the amount received as remuneration for quality or quantity of the labor.

(2) Reasons for calculating ordinary wage

Ordinary wage applies to ① dismissal allowances replacing advance notices of dismissal, ② wage added for overtime, night, or off-day work, ③ ordinary wage stipulated in the rules of employment to calculate annual paid leave, and ④ in cases where the pay is under ‘paid allowance,’ not under average wage according to the Labor Standards Act.

(3) Methods of calculating ordinary wage

When calculating ordinary wage, the hourly wage rate is applied in principle. Daily wage, weekly wage, monthly wage, or subcontract wage can be calculated at the hourly wage rate as in the following:

1) Hourly wage rate of daily wage

With respect to wage determined by the daily wage rate, the amount is calculated by dividing the daily wage rate by the contractual working hours per day. Contractual working hours represent those working hours which the workers and employers have agreed upon within the limit of the legal standard working hours(Article 2(7) of the LSA).

2) Hourly wage rate of weekly wage

With respect to wage determined by the weekly wage rate, the amount is calculated by dividing the weekly wage rate by the contractual working hours per week. Weekly wage refers to ordinary wage that are to be paid on a weekly basis.

3) Hourly wage rate of monthly wage

With respect to wage determined by the monthly wage rate, the amount is calculated by dividing the monthly wage rate by the contractual working hours per month. Monthly wage refers to ordinary wage that are to be paid on a monthly basis.

In cases where legal standard hours are regulated to the same as contractual working hours, the calculation is as follows:

⇒ Where legal standard hours mean 40 hours weekly, excluding rest hours

Standard hours calculated for monthly ordinary wage = (40 hours + 8 hours) x 4.345 weeks ≒ 209 hours

4) Hourly wage rate of subcontract wage

With respect to wage determined by the subcontract wage system, the amount is calculated by dividing the total sum of wage under the subcontract wage system for the period of wage calculation by the whole number of working hours during that period.

[Ministry of Employment and Labor Guidelines]

1) As long as the welfare allowance is paid periodically and uniformly, it shall be included in the realm of ordinary wage.63)

In cases where the welfare allowance has been paid to all employees periodically and uniformly for the contractual working hours or legal standard working hours for the purpose of supplementing the low wage level of employees working in social welfare facilities, this allowance shall be included in the realm of ordinary wage. Here, the term “periodic” means that the employer shall pay wage for contractual working hours or legal standard working hours. The term “uniform” means that the employer shall not only pay all employees, but also pay all employees who meet a certain condition or reach a certain level of working conditions.

2) Even though the company and the labor union agree in a collective bargaining agreement to include into ordinary wage those wage and valuables which are exclusive in the realm of ordinary wage according to the LSA guidelines, it is not possible to deem that they are converted to ordinary wage by the law.64)

If a company decides by collective bargaining agreement (CBA) and the rules of employment to include into the realm of ordinary wage valuables which are not included in the realm of ordinary wage according to LSA regulation, the company shall follow the promised rules. However, even though the company and the labor union agree in the CBA and rules of employment to include into ordinary wage those wage and valuables which are exclusive in the realm of ordinary wage according to LSA guidelines, it is not possible to deem that they are converted to ordinary wage according to Article 6 of the Enforcement Decree to the LSA.

2. Substantial Criteria for Determining Ordinary Wage

(1) Concept of ordinary wage

Recent judicial rulings concerning rules for calculation and scope of ordinary wage have differed from MOEL Guidelines to MOEL Guidelines, something which has caused much confusion for corporate management. However, the Supreme Court, with all judges in attendance, offered clarification on December 18, 2013 and December 19, 2024: ‘Ordinary wage’ means wage which are determined to be paid periodically or in a lump sum to an employee for their prescribed work or whole work. This ordinary wage is used as the standard wage to calculate added allowance for overtime, night and holiday work, annual paid leave allowance, dismissal pay, and for paid leaves that employers have to provide under the Labor Standards Act. If this ordinary wage has not been calculated properly, it is not as simple as re-calculating and paying the correct amount from now on, but the employer shall recalculate all kinds of allowances such as overtime, night and holiday work, and other allowances that were paid over the past three years. Furthermore, the employer shall recalculate the severance pay for resigned or dismissed employees and pay the difference.65)

(2) Legal criteria for determining ordinary wage

1) Ordinary wage means wage that an employer pays to an employee as remuneration for their prescribed work or whole work, and those which are paid regularly and uniformly are considered ordinary wage in principle. For legislating the Labor Standards Act and the function and necessity of ordinary wage, what should be included as ordinary wage shall be fixed wage paid regularly and uniformly. This means non-fixed wage are not ordinary wage, as they are not paid regularly and uniformly and may or may not be paid. Here, being paid ‘uniformly’ not only means that payment is made to all employees, but also to all employees qualified according to certain conditions or criteria. Here, ‘certain criteria’ refers to ‘fixed conditions’ in considering the concept of ordinary wage, because the ordinary wage is used to calculate ‘fixed and generally accepted regular wage.’66)

2) Even though a particular allowance or bonus, etc., may be paid for a period exceeding one month, if these are paid regularly and uniformly, these components can be included in ordinary wage.67)

3) Mutual agreements between employer and employees that exclude a particular allowance from consideration as ordinary wage according to the Labor Standards Act are null and void because such an agreement sets conditions lower than that of the Labor Standards Act.68)

(3) Application of ordinary wage

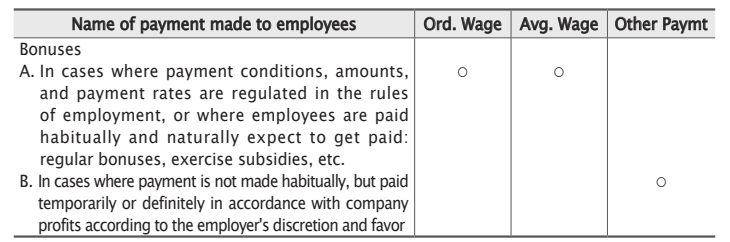

1) Bonuses

Bonuses are included into the realm of ordinary wage even if they are not paid regularly every month. Rules for calculating ordinary wage explain the bonus as follows69)(The Supreme Court en banc rulings on ordinary wages from 2013 and 2024 have been applied.).

① As the regular bonus is paid regularly and uniformly(e.g. 100% paid every even month) as fixed

wage for labor service, it shall be considered ordinary wage as stipulated in the Labor Standards Act.70)

② The bonus in this case is only applicable to employees working for six months or more with a certain amount paid quarterly, and calculated according to the number of years of service. This bonus is paid every quarter, distinguishing it from annual salary divided into monthly payments, but this difference in payment time does not preclude it from being considered as ordinary wage. As the bonus in this case has been previously fixed, it shall be considered ordinary wage as it is a fixed wage paid regularly and uniformly.

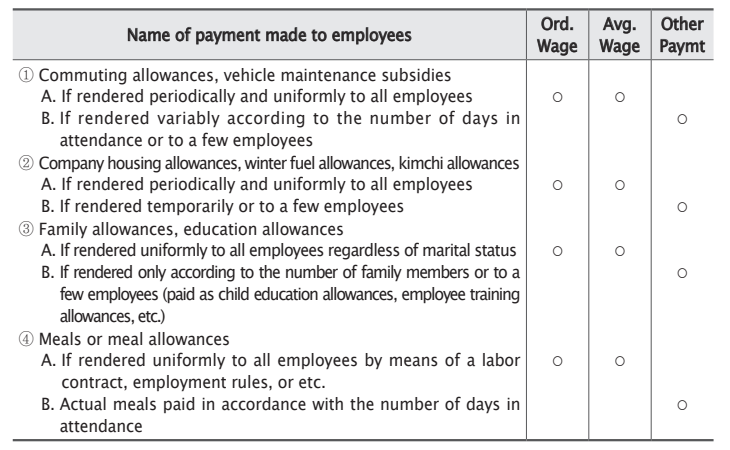

2) Payments made for an employee’s living costs or welfare, regardless of working hours

① A certain company has paid all cleaning workers a fixed meal allowance, household subsidy, transportation subsidy, morning meal costs, sanitation allowance, and snack allowances as fixed amounts every month, all of which shall be considered ordinary wage to be paid

regularly and uniformly as reward for labor service.72)

② If a welfare allowance has been paid uniformly, regularly, and at a fixed rate to all employees of the same business according to the collective wage agreement, this is not money paid temporarily and according to favor for welfare, but wage paid as remuneration for labor service according to employment relations. In addition, this is not wage paid individually or at a variable rate, but fixed wage for ordinary working days and working hours, so shall be considered ordinary wage.73)

③ Even though some employees with lower work attendance rates have been paid transportation and meal allowances differently than other workers, these allowances have been paid to all employees and shall be considered ordinary wage.74)

④ Even though a company enters into an agreement with employees that it will not calculate into ordinary wage the meal allowances that have been paid at a fixed rate to all employees, this shall be considered an illegal employment contract.75)

⑤ Service allowances have accumulated according to the length of service for all cleaning workers employed for at least one year; meal, transportation, sanitation, and hazard allowances have been paid at a fixed rate every month to all cleaning workers. Quarterly, attendance, exercise, and traditional holiday allowances have been paid to all cleaning workers regularly and at a fixed rate if they meet certain criteria. As these allowances are fixed wage paid regularly and uniformly as reward for labor service, they shall be considered ordinary wage.76)