Chapter 3 Wages

- Section 1: Wages and Labor Law - Ⅰ. Wage Requisites and Standards for Judgment

-

Article 2 (5) of the LSA. Definition of wage

The term “wage” means wage, salary, and any other money or valuables, regardless of its title, which the employer pays to a worker as remuneration for work.

1. Wage Requisites

(1) Paid by the employer

Given that wage are what the employer pays to the employee, the service charge that a worker receives from customers in a hotel or restaurant cannot be considered as wage in principle.

(2) Remuneration for work

As wage are paid as remuneration for work, they cannot be deemed to be wage if the employer renders payment under friendly and favorable terms outside of work, or if the employer provides pay as part of welfare, or if the employee receives reimbursement for actual expenses.

(3) Any payment regardless of label

wage are paid in forms of salary or allowance in general. If the employer is paying remuneration for work to the subordinate employee, it is considered wage, regardless of what label the payment is given. Accordingly, we shall not estimate information allowance and

welfare fees as wage just by their titles, because wage are differentiated by payment conditions.

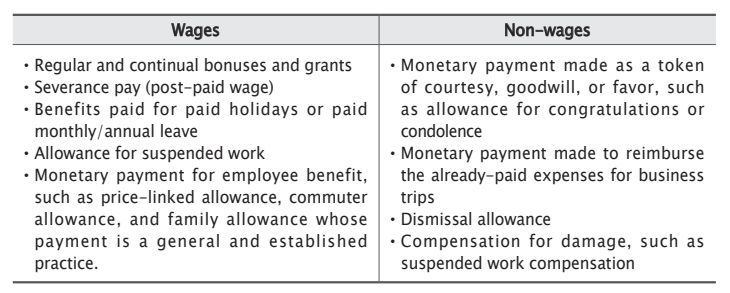

2. Concrete Criteria for Wage

(1) Money paid under friendly and favorable terms is not considered to be wage

Money is not considered wage if paid for optional, courteous, and friendly reasons including congratulatory and consolation allowances, awards for quality control activities, or money paid favorably to celebrate special occasions such as the company’s foundation day.

(2) Money paid for actual expenses is not considered wage

Money paid to reimburse actual expenses for the purchase of production instruments such as security equipment is not wage. Reimbursements for purchase of work uniforms, tools and materials, business trip expenses, travelling expenses, account expenses, confidential expenses, and information fees are also not considered wage.

(3) Welfare allowances are not considered wage (in principle)

The welfare allowance in its true meaning is not a wage because it cannot be treated as remuneration for work. However, if paid regularly to all workers in accordance with the collective agreement, rules of employment, or a repeated precedent, it is considered wage under the Labor Standards Act.

● Regular and continual bonuses and grants

● Severance pay (post-paid wage)

● Benefits paid for paid holidays or paid monthly/annual leave

● Allowance for suspended work

● Monetary payment for employee benefit, such as price-linked allowance, commuter allowance, and family allowance whose payment is a general and established practice.

● Monetary payment made as a token of courtesy, goodwill, or favor, such as allowance for congratulations or condolence

● Monetary payment made to reimburse the already-paid expenses for business trips

● Dismissal allowance

● Compensation for damage, such as suspended work compensation