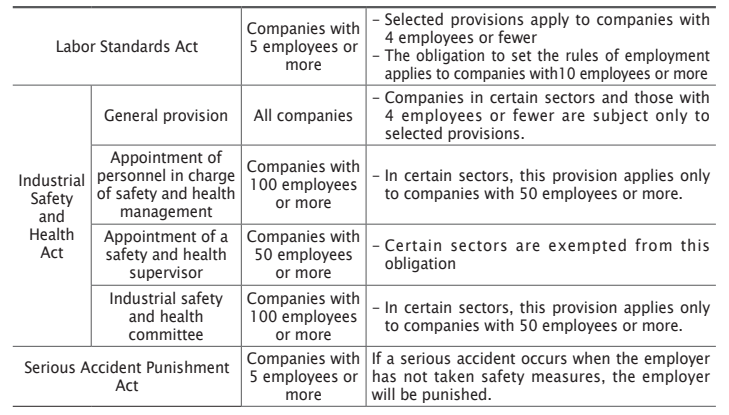

[Labor Standards Act]

# Companies with 5 employees or more

- Selected provisions apply to companies with 4 employees or fewer

- The obligation to set the rules of employment applies to companies with10 employees or more

[Industrial Safety and Health Act]

< General provision>

# All companies

- Companies in certain sectors and those with 4 employees or fewer are subject only to selected provisions.

# Companies with 100 employees or more

- In certain sectors, this provision applies only to companies with 50 employees or more.

#Companies with 50 employees or more

- Certain sectors are exempted from this obligation

# Companies with 100 employees or more

- In certain sectors, this provision applies only to companies with 50 employees or more.

[Serious Accident Punishment Act]

#Companies with 5 employees or more

- If a serious accident occurs when the employer has not taken safety measures, the employer will be punished.

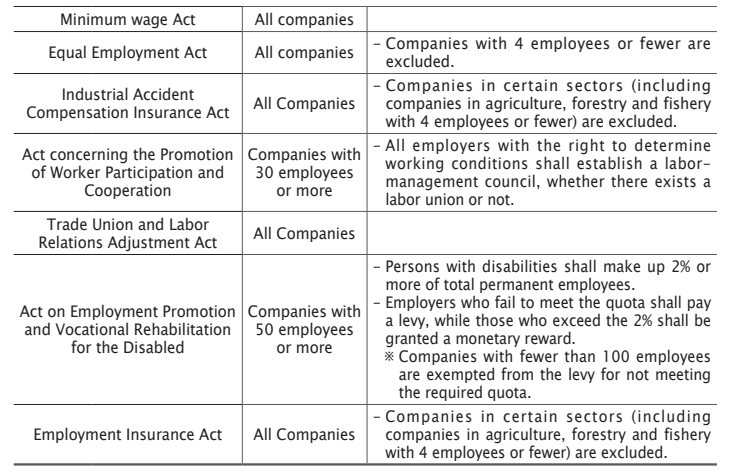

[Minimum wage Act]

# All companies

[Equal Employment Act]

# All companies

- Companies with 4 employees or fewer are excluded.

[Industrial Accident Compensation Insurance Act]

# All Companies

- Companies in certain sectors (including companies in agriculture, forestry and fishery with 4 employees or fewer) are excluded.

[Act concerning the Promotion of Worker Participation and Cooperation]

# Companies with 30 employees or more

- All employers with the right to determine working conditions shall establish a labor- management council, whether there exists a labor union or not.

[Trade Union and Labor Relations Adjustment Act]

# All Companies

[Act on Employment Promotion and Vocational Rehabilitation for the Disabled]

# Companies with 50 employees or more

- Persons with disabilities shall make up 2% or more of total permanent employees.

- Employers who fail to meet the quota shall pay a levy, while those who exceed the 2% shall be granted a monetary reward.

※ Companies with fewer than 100 employees are exempted from the levy for not meeting

the required quota.

[Employment Insurance Act]

# All Companies

- Companies in certain sectors (including companies in agriculture, forestry and fishery with 4 employees or fewer) are excluded.